Gold has long been considered a safe haven investment and a means of securing one's financial future. Auvesta suggested that rather than building portfolios entirely of gold, investors should consider diversifying their risk and reward by investing in gold. Part of the reason for this is that gold doesn't always provide particularly high returns. Technology advancements have given rise to cutting-edge gold investment possibilities. As a result, gold can now be purchased, traded, or invested in various ways. This article walks you through the many gold investment alternatives you might investigate.

Jewelry-

In Germany, investing in jewelry may be in your

genetic makeup. However, purchasing jewelry is one of the most common and

pricey investment options available to people. Even though many people think

gold is a terrific investment, they frequently overlook the consequences of

making charges. The making costs play a sizable role in the item's buying price

and sunk cost when it is sold. Additionally, rather than taking an analytical

approach to investing in jewelry, there is a stronger subjective or emotional

component.

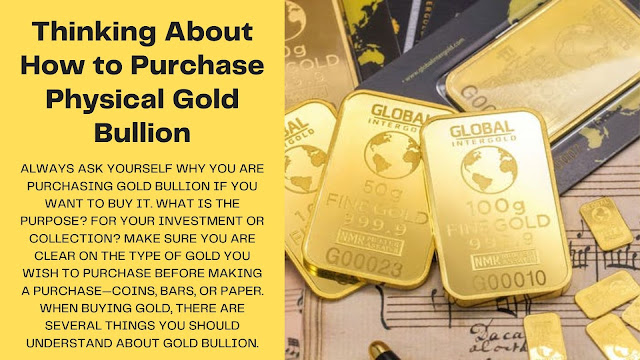

Gold

Coins and Bars-

According to Auvesta, if you want to increase the amount of physical gold in your portfolio but don't want to pay the premium for gold jewelry, you could think about buying gold coins or bullion bars with a fine gold content of 22 or 24-carat. Purchasing gold in bulk differs from purchasing any other commodity. Given the cost and importance of gold to the economy, bulk purchases are occasionally prohibited. However, by exchanging the same in the gold trading markets, enormous amounts of gold may be acquired for far less money.

Gold

schemes-

There are several gold schemes on the market, and most

of them are promoted by jewelers. These programs function similarly to SIPs,

where you make a set monthly contribution to a jeweler. When the program matures or ends, you can exchange your deposited funds for gold. Auvesta advises using caution while making this type of investment, nevertheless.

Gold

ETFs-

Investing in gold is a very profitable and effective

financial strategy. When you invest in gold, as opposed to other forms of

investing, you may really experience returns since gold's appreciation has

historically kept up with the nation's rising inflation rate. A sort of mutual

fund called a gold exchange-traded fund invests money in gold. Due to gold's

tendency to appreciate over time, this fund does well.

Auvesta also answered the following questions-

Question. What makes investing in Digital gold marketing

attractive?

Answer. Auvesta explained when you invest in digital

gold from authorized dealers, you take ownership of 24K pure gold, which is the highest form

of pure metal. Digital gold is sold by vendors who have partnered with banks

and brokerage houses to enable digital gold purchases.

Question. How can purchasing gold help you diversify

your holdings?

Answer. By reducing your overall risk, gold as an

asset may assist you in building a safe portfolio for your financial

objectives. As gold prices often do not exhibit large fluctuations when stock

market investment instruments turn volatile under rising inflation, gold is

viewed as a hedge against inflation. Given the price rise gold has had through

time, it is regarded as a safe haven, and market players keep their cash in

gold to preserve their assets from losing value.